How To Take Tds Paid Challan

Tds online payment: procedure to pay tds How to download tds challan and make online payment Pay self assessment tax

How to pay TDS online, Tds Challan, Tds Challan form 281 | Tds challan

How to pay tds challan in online mode|challan no 281|live demo|tds u/s How to generate challan form user manual Tds challan how to download paid tds challan and tcs challan details on

How to pay tds online, tds challan, tds challan form 281

Tds payment process online on tin-nsdlOnline tds challan payment process Pay tds online with e payment tax tds challan itns corpbizView challan no. & bsr code from the it portal : help center.

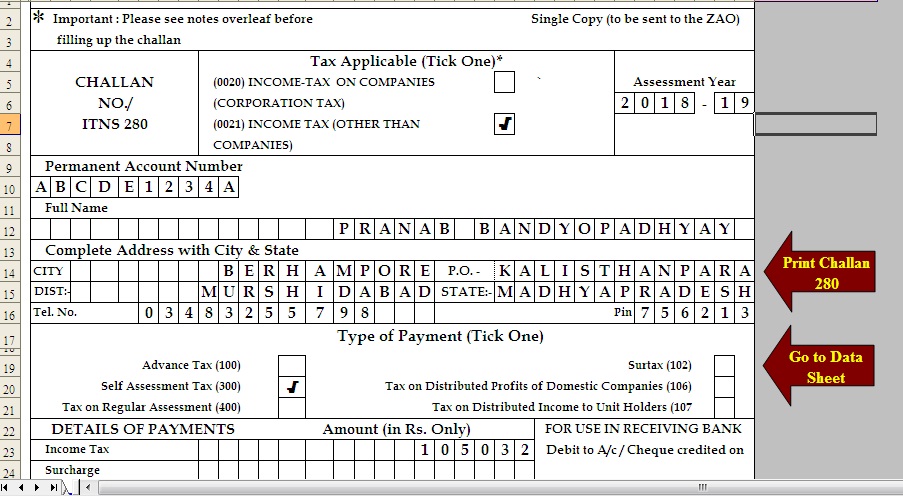

Procedure after paying challan in tdsHow to download tds challan and make online payment Free download tds challan 280 excel format for advance tax/ selfView client details (by eris) > user manual.

Law and procedure of tds payment challan and returns under 194m

Tds challan paying salary computationTds/tcs tax challan no./itns 281 How to check tds challan status on onlineTds challan 194m procedure law return.

How to download tds challan and make online paymentHow to pay tds online tds challan tds challan form tds challan Paid tds in wrong section or head? online step wise process to correctE-tds return file| how to download tds challan (csi) from income tax.

Challan tds 281 tcs itns

How to pay online tds/tcs/demand payment with challan itns 281Tds challan pay Tds deposit new process through login of income tax portal|how toTds challan.

Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details taxHow to reprint income tax challan after payment| how to download income How to download tds challan and make online paymentTds challan 281 excel format fill out and sign printa.

Tds challan 16c 26c

How to check tds challan status onlineHow to download tds challan from online? Challan tds status check online nsdl steps easyChallan tds.

Tds payment challan excel format tds challana excel formatHow to download paid tds challan and tcs challan details on e-filing How to pay tds online, tds challan, tds challan form 281How to pay tds rent above 50,000 using challan 26c and form 16c? – gst.

E-pay tax : income tax, tds through income tax portal

Income tax challan status: how to check tds challan status? .

.